south dakota motor vehicle sales tax rate

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased. In addition to taxes car.

Sales Tax Tuesday 2018 South Dakota Insightfulaccountant Com

A bidder must be licensed as a Highway Contractor.

. The South Dakota sales tax and use tax rates are 45. Returns and any fuel tax payment due must be filed and remitted on or before the twentieth day of the month following each quarterly period. The South Dakota Department of Revenue administers these taxes.

That is the amount you will need to pay in sales tax on your. Motor vehicle fuel tax. South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average.

First multiply the price of the car by 4. The sales tax on a car purchased in North Dakota is 5. Different areas have varying additional sales taxes as well.

The highest sales tax is in Roslyn with a. For vehicles that are being rented or leased see see taxation of leases and rentals. South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average.

All car sales in South Dakota are subject to the 4 statewide sales tax. South dakota charges a 4 excise sales tax rate on the purchase of all vehicles. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

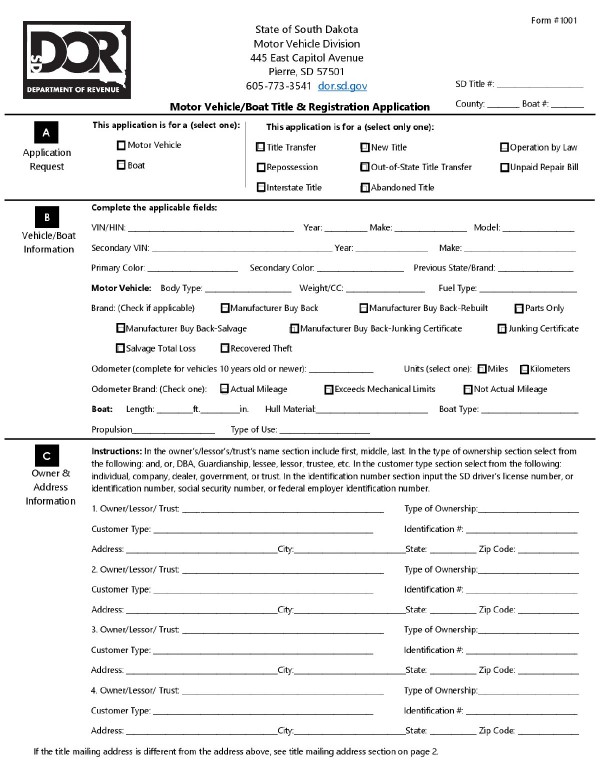

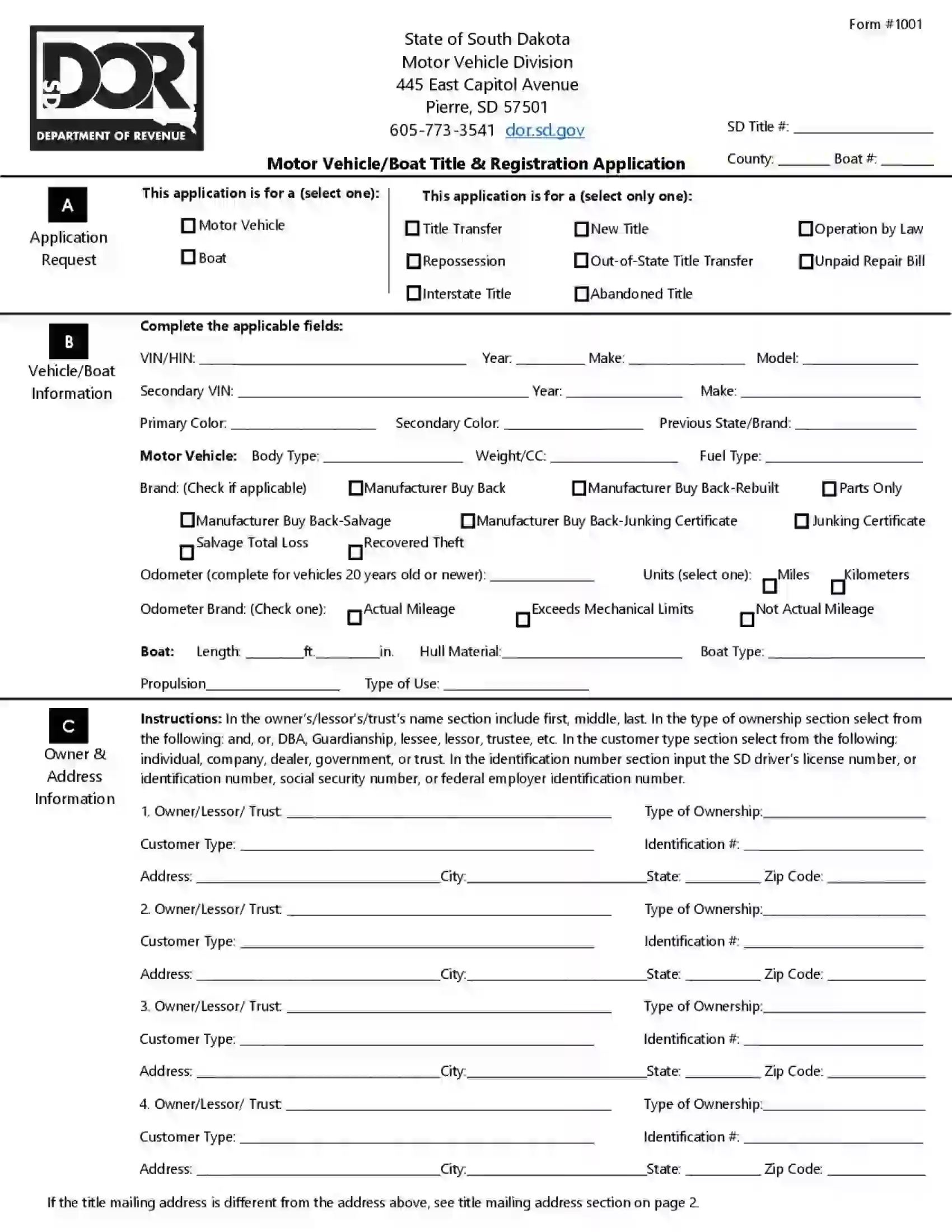

Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

31 rows The state sales tax rate in South Dakota is 4500. With few exceptions the sale of products and services in South. They may also impose a 1 municipal gross.

Applicable municipal sales tax motor vehicle gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. 4 State Sales Tax and Use Tax Applies to. Municipalities may impose a general municipal sales tax rate of up to 2.

Tax Rate State sales tax 45 2115 Rapid City sales tax 2 940 Tourism Tax 15 705 Motor Vehicle Gross 45 2115 TOTAL DUE 52875 Fees charged for driving a motor vehicle. Though you can save money you know the payments involved to register your car with. If you want to buy cars South Dakota is among the top ten most tax and fee-friendly places in the US.

South Dakota charges a 4 excise sales tax rate on the purchase of all. If you are interested in the sales tax on vehicle sales. To calculate the sales tax on a car in South Dakota use this easy formula.

South Dakotas sales and use tax rate is 45 percent. The SD sales tax applicable to the sale of cars. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax.

The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. 1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases.

South Dakota Income Tax File Old Tax Returns

Dmv Fees By State Usa Manual Car Registration Calculator

Home South Dakota Department Of Revenue

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

State Local Tax Burden Rankings Tax Foundation

Sales Taxes In The United States Wikipedia

Nj Car Sales Tax Everything You Need To Know

Municipal Sales Taxes To Go Unchanged South Dakota Department Of Revenue

How To File And Pay Sales Tax In South Dakota Taxvalet

Cars Trucks Vans South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

How Is Tax Liability Calculated Common Tax Questions Answered

Form E1334 V2 Fillable Affidavit Of Vehicle Repossession

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Use Tax South Dakota Department Of Revenue

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator